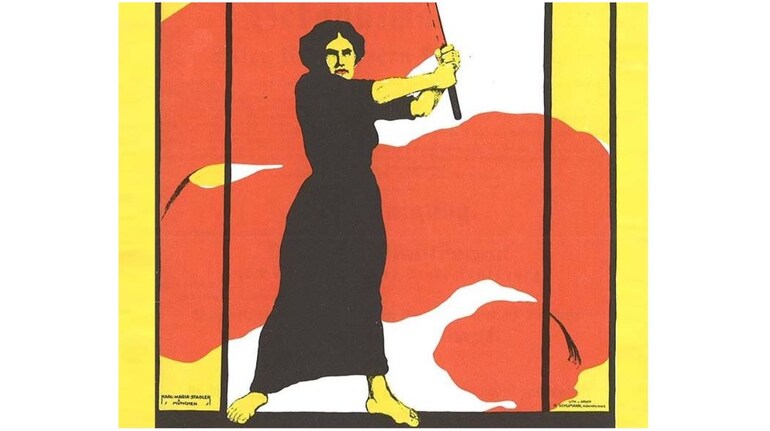

Why are women hesitant to take charge of their finances?

According to a recent survey by LXME, in association with Axis My India, 33 percent of women in India do not invest at all, and the number is as high as 40 percent in the 21-25-years age group.

Shweta is an ambitious and diligent 34-year-old working woman from Bangalore, India. She is married and manages two kids, a family, and a team of eight people at work, all by herself. She is a delivery manager in a well-known IT company where she plans and develops project ideas, makes presentations, monitors project progress, sets deadlines, fixes bugs, ensures stakeholder satisfaction, evaluates performance, keeps up with tech trends, decides what food to make and which math table her kid should memorise for the weekly test.

Despite being capable and proactively involved in all the day-to-day activities, she misses on one of the most important aspects of life — managing her money and finance.

Disturbing numbers

According to a recent survey by LXME, in association with Axis My India, 33 percent of women in India do not invest at all and the number is as high as 40 percent in the 21-25-years age group.

Overall, 55 percent of women in the country are unaware of their investments, the survey added.

Shweta is an ambitious and diligent 34-year-old working woman from Bangalore, India. She is married and manages two kids, a family, and a team of eight people at work, all by herself. She is a delivery manager in a well-known IT company where she plans and develops project ideas, makes presentations, monitors project progress, sets deadlines, fixes bugs, ensures stakeholder satisfaction, evaluates performance, keeps up with tech trends, decides what food to make and which math table her kid should memorise for the weekly test.

Despite being capable and proactively involved in all the day-to-day activities, she misses on one of the most important aspects of life — managing her money and finance.

Disturbing numbers

According to a recent survey by LXME, in association with Axis My India, 33 percent of women in India do not invest at all and the number is as high as 40 percent in the 21-25-years age group.

Overall, 55 percent of women in the country are unaware of their investments, the survey added.

Typically, women have good saving habits and attention to detail, two very important qualities for wealth creation, in their genes. Despite these innate strengths essential for money management many women end up just saving and not investing. And the majority of the ones who choose to invest, go for traditional options like gold jewellery and fixed deposits, PPF, Endowment Policies, etc, 42 percent and 35 percent stating as their top choices are gold and fixed deposits respectively; not adequate enough to hedge against inflation and build wealth for themselves.

Despite being the sixth-biggest equity market globally, it has among the lowest women participants. While the investment arena in the world is male-dominated, the gender gap in India is wider, with women making up just 21 out of 100 investors, at the very least compared to other emerging markets, such as China (34%), South Africa (33%) and Malaysia (29%) , according to the data by BrokerChooser.

Also Read: Are Men and Women Really Equal When It Comes To Investing Money?

You are not alone

The above situation is not true just for Shweta, but also for many other Indian working women like her, employed as IT professionals, bankers, accountants, doctors, chefs, fashion, media or from other domains. The main reasons for women not investing money in the stock markets are lack of time, proper financial knowledge, and the fear of losing their entire savings. Today, with technological advancements and more awareness in the field of finance, seeking professional help is just a matter of a few clicks away.

However, one of the major problems lies in the mindset of people. Many women fear seeking help and assistance when it comes to their savings. They are willing to pay making charges, and locker charges for gold jewellery; they will settle for small interest rates on bank deposits, but won’t pay a 2.5 percent fees to an expert who can use his/ her expertise in the domain and make the equity investing process smoother. And the fault isn’t entirely theirs. It needs an empowered society to empower women to a level to be able to make wise and informed money decisions by themselves, for themselves.

Why equities for women?

The above facts and figures portray an inspiring scenario for women like Shweta in investing. Women have broken the glass ceiling in all spheres of life, be it politics or education. Despite the economic downturn post the outbreak of COVID-19 leading to job losses and pay cuts, one of the positives to emerge was the increasing participation of women in equity investments.

Traditional options like gold jewellery and fixed deposits (FD), traditional insurance policies, etc as discussed above are among the most preferred investment choices for many women. However, such options do not generate more than 5-6 percent per annum in returns. The average long-term inflation rate in India has been 6.50 percent in the last decade.

Let us not forget: FD interests and physical gold come with a tax burden. It means these financial vehicles are working in their first gear, not properly aligned with your goals to reach the destination of wealth creation. Investing in these options is a sure-shot way of eroding your hard-earned money rather than building on it. On the contrary, if history is any proof, equity is the only asset class that has outperformed all its counterparts over the last 126 years.

The way forward

The need of the hour is to bring more women like Shweta into the equity investing game.

The easiest and safest way to go about the idea for Shweta will be to read and understand more about equity instruments and seek help from Certified Financial Planners or SEBI-Registered Investment Advisors for better clarity and planning of long-term financial goals.

Women should certainly take charge of their own money, just like today’s women have taken charge of their careers.

This article was originally published on moneycontrol.com by the same author.

About Author

Vinayak Savanur

Founder & CIO at Sukhanidhi Investment Advisors, a SEBI registered equity investment advisory firm. He has nearly a decade of experience in the stock markets and has been a holistic financial planner.

We send you fresh and insightful finance newsletter every week. Subscribe here to never miss an update. To explore great investment opportunities in Direct Equities, give us a call at

Mastering the Market: The Crucial Role of Emotional Intelligence in Investment Success!

Mastering the Market: The Crucial Role of Emotional Intelligence in Investment Success! Emotional intelligence (EI) plays a significant role in determining success in the stock

CONSIDER INVESTING IN OUR ELITE EQUITY PORTFOLIO RATHER THAN PURCHASING GOLD THIS AKSHAYA TRITIYA!

CONSIDER INVESTING IN OUR ELITE EQUITY PORTFOLIO RATHER THAN PURCHASING GOLD THIS AKSHAYA TRITIYA! WHAT IS IT ABOUT AKSHAYA TRITIYA AND GOLD? An age-old ritual

Silver Outshines Gold as the Long-Term Investment Darling Due to Expansive Industrial Applications!

Silver Outshines Gold as the Long-Term Investment Darling Due to Expansive Industrial Applications! Silver, often overshadowed by its illustrious cousin gold, possesses its own unique